Comparing Index Funds for Fidelity, Charles Schwab, and Vanguard

Written By: Nick Nguyen | Read full profile

This post contains affiliate links which means if you click on a link and choose to make a purchase I may receive a commission at no additional cost to you. You are not obligated to do so, but it does help fund these blogs in hopes of bringing value to you! See our disclaimer for more information.

A few posts back, I wrote a comparison on Fidelity vs. Charles Schwab vs. Vanguard for your Roth IRA. Honestly, you can use any of these brokerages for IRAs, 401ks, 403bs, 457(b)s, taxable accounts, etc. They’re all rock solid!

But if you’re still on the fence about it, what helped me make my final decision was taking a look at the index funds they offered and the expense ratios involved.

Now remember, you can (and should) consider investing in index funds for any and all of your accounts whether taxable or tax-advantaged if you’re investing for the long-term. As I’ve mentioned in a previous post, the total stock market has proven to continue to go up and up and up at an average of 6-7% each year. Some years you might be negative, but other years, like in 2019, the market surged 30%!

So....my point is index funds are a great way to affordably and passively invest your hard earned money.

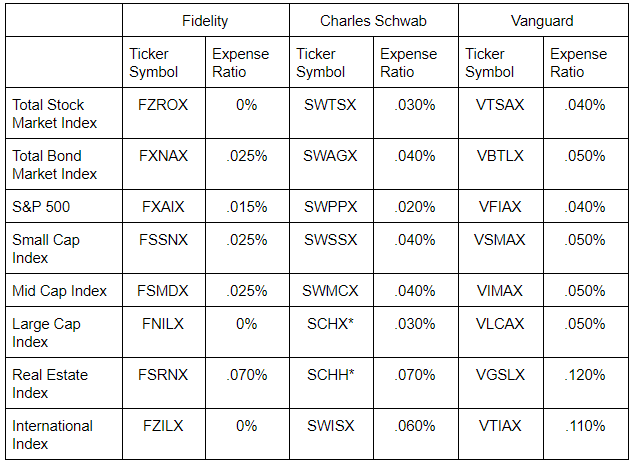

Here are the 8 most common index funds investor’s think about when building their portfolio

*Charles Schwab doesn’t have the equivalent index fund, but they do have an equivalent ETF, which is essentially a stock version of the fund.

As you can see, Fidelity had the lowest overall expense ratios, especially after rolling out their ZERO cost index funds. Schwab came in a close second fee-wise with Vanguard last. Now, normally this doesn’t mean much. The difference is $3-12 dollars per every $10,000 you have in your account.

Now if those last couple of dollars matter to you, woohoo! You got your answer! But honestly, pick the funds based on their prospectus, returns, and history (plus who you end up choosing to go with for your brokerage).

That’s all folks! Feel free to check out our post on how to use index funds to invest like a pro!

*Nguyening Lifestyles is not a registered financial service provider and does not give financial advice. All information in these posts are for entertainment purposes only. Nguyening Lifestyles is not liable for any actions or outcomes that transpired after your reading of the following post.

Recommended posts: