5 Best Bank Accounts I haven't Divorced

Written By: Nick Nguyen | Read full profile

This post contains affiliate links which means if you click on a link and choose to make a purchase I may receive a commission at no additional cost to you. You are not obligated to do so, but it does help fund these blogs in hopes of bringing value to you! See our disclaimer for more information.

So you just watched my video on how to trick your brain to afford anything? (If not, you can check it out here.) But, in the video, you will have heard me mention that I split the little money I earn into 7 different bank accounts to trick myself into thinking I’m poor - cause ain’t nobody got time to go logging into 7 different accounts every day.

Anyways, I wanted to let you know the top 5 that I love...or at least haven’t taken my money out of...yet… in this particular order:

So I absolutely love Charles Schwab because it’s 100% fee-free with no minimums, their online portal is magnificently simple and easy to use, and they have 24/7 chat support who are incredibly friendly! As of July 2020, their checking account provides a 0.03% APY (used to be 0.25% APY), which isn’t the highest, but is pretty awesome considering you don’t have to have a specific amount of money in it to start earning. Their debit card looks super high-end, and all their ACH transfers to other accounts and checks are completely free! You may have to pay for things like cashiers checks, but if you travel internationally a lot, they do not charge a foreign exchange fee nor do they have any ATM fees (you’ll get credited back the ATM fee at the end of the month). If you deposit $1000 initially, you can get $100! Here’s the referral link (Note: we don’t get anything for this referral, but you can only get the $100 if you know someone with a Schwab account, so we got you fam!).

This is technically a cash management account that functions as a checking account. All this means is that it’s a hybrid account that brings together elements of a checking, savings, and sometimes even investment account. Fidelity’s is great because it has no minimum balances, no account fees, and you get all your ATM fees reimbursed. Another perk is that you get your money a whole 24 hours earlier than your pay date! Checks are free and your debit card looks like a swanky business card! The downside is they don’t have a lot of physical locations, their dashboard isn’t the most user friendly, and they charge 1% foreign exchange fees. They also provide a 0.01% interest rate as of July 2020.

I opened an account with Chase when I was in college to get all the monthly maintenance fees waived through a student account and just kept it ever since. They have a lot of physical locations and ATMs, which makes it easy to deposit checks and cash! The dashboard is incredibly nice and user friendly, and if you open a credit card through chase, it’s really easy to set up payments and get extra bonuses at specific stores! Using Zelle through Chase’s platform is also very easy. Chase doesn’t normally charge for transfer fees unless it’s a bank wire, and their cashiers check fees are relatively affordable if you need one real time. They frequently provide coupons to get an extra $100-200 if you open a higher tier checking account or savings account, but I got the $100 bonus with a minimum direct deposit each month, so I stuck with it! It can be difficult to open the account online though, so going into a branch will run you 15-20 minutes to get everything set up. The more money you have and the higher tier your account, the more perks (free checks, waived fees, interest, etc.) you get.*

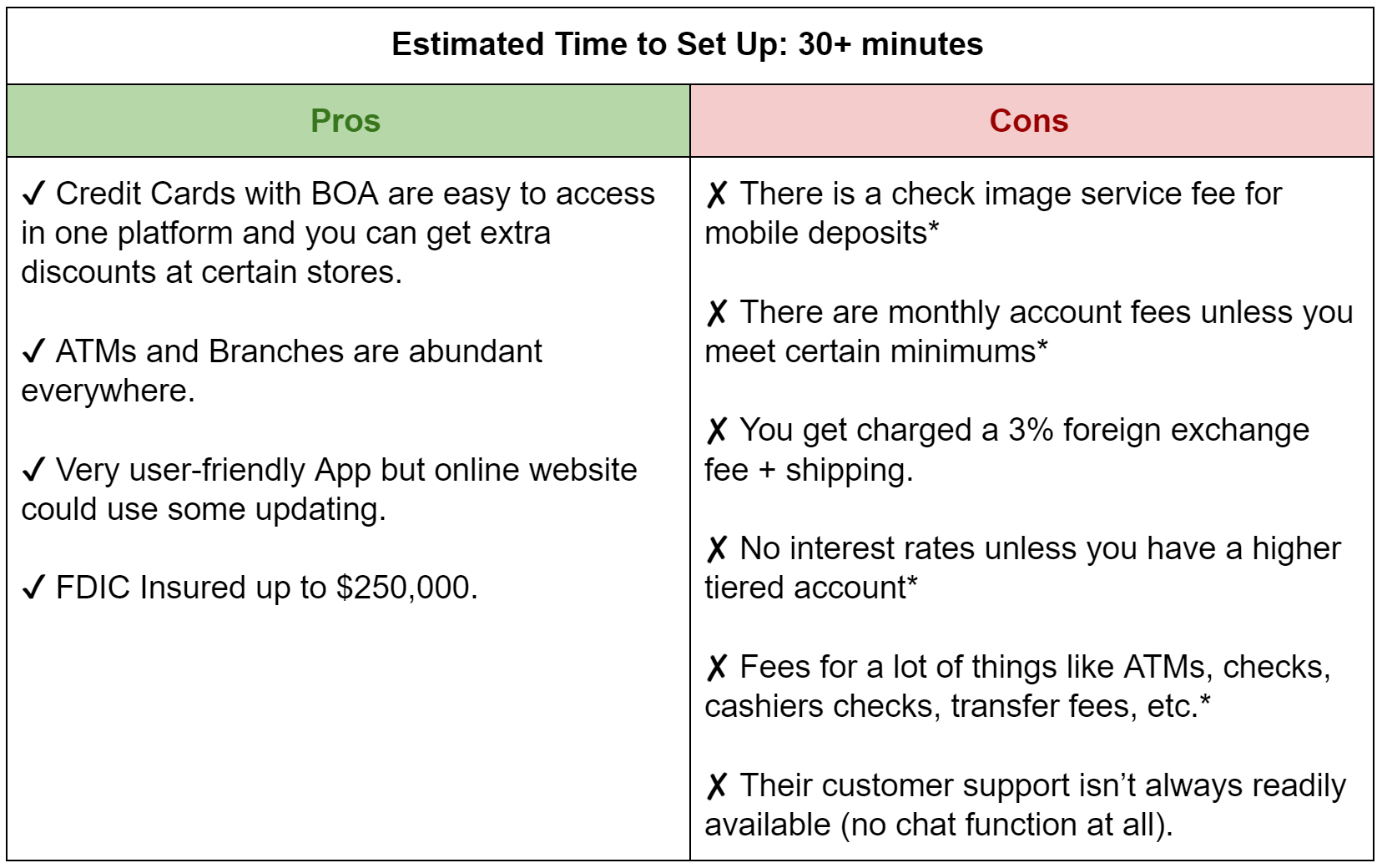

Bank of America was the second account I ever got and honestly, the oldest account I have. They have a ton of physical locations, but the downside is there are a lot of fees for everything if you’re not careful. Make sure you maintain an account minimum or satisfy any direct deposit requirements to waive that monthly fee. Their online interface and app are nice, but a bit primitive. It’s a little confusing to use zelle through the website platform, but the App is solid! They also have extra deals with specific stores pop up every now and then if you use your debit/credit card! I just hate their ATMs because most of them still eat your card if you put the pin in wrong. And don’t order foreign currency from them, you get charged an exchange rate and a shipping fee to get the cash to your local bank. If you’re lucky, BOA reps typically come to colleges during the first couple of weeks and advertise a $25 bonus for opening a checking and/or saving (so you can get up to $50) with a minimum deposit! Setting things up online was not the easiest at all, so you’ll have to go in, and in my experience, it’ll typically take you a minimum of 30 minutes to set up an account.

If you have a TON of cash, you may qualify for higher tiers with all the extra perks, bonus points on their affiliated credit cards, and little to no fees on things like checks, cashiers checks, ATM fees, etc.*

This is my newer bank. I opened one because their savings account was still going at a 1.0% interest rate APY even through the pandemic, which was by far very high! What I like about this account is that there are no fees nor minimums and their online system is pretty easy to work with. It’s sleek but incredibly basic. What I love is that they have chat support and friendly customer service and online setup was very easy. I had the account within 10 minutes. Their checking accounts also have no fees and offer a 0.10% interest rate as of July 2020. They were offering a $25 bonus for opening a checking or savings account if you had a friend’s referral code and if you followed certain requirements like had a certain number of transactions and a minimum balance. I’d love to give you a referral link, but it seems like only certain accounts have it, but when it comes to mine, I’ll make sure to add it here for you!

*Nguyening Lifestyles is not a registered financial service provider and does not give financial advice. All information in these posts are for entertainment purposes only. Nguyening Lifestyles is not liable for any actions or outcomes that transpired after your reading of the following post.

Recommended Posts: