6-Figure Salary? TOO BAD! You’re not as rich as you think you are!

Written By: Nick Nguyen | Read full profile

This post contains affiliate links which means if you click on a link and choose to make a purchase I may receive a commission at no additional cost to you. You are not obligated to do so, but it does help fund these blogs in hopes of bringing value to you! See our disclaimer for more information.

Listen to the audio version of the blog:

A lot of people think that the path to becoming richer means making more money. Heck, for the longest time, I kept thinking it was time for me to get a new job that pays me $80,000 a year instead of staying broke on my measly Research Assistant salary of $36,000 a year.

But when the time came and I was staring at an $80,000 salary position, I didn’t take it. Why? Because the more you make, the more Old Man Sam takes from you.

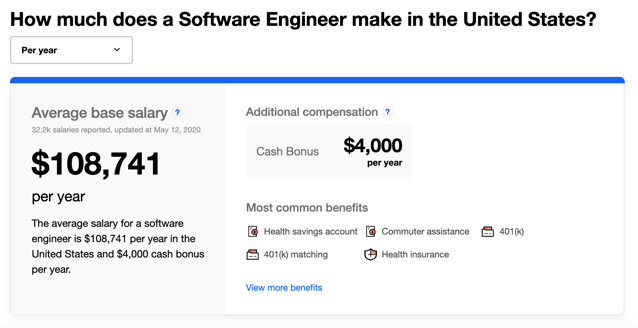

Now let’s say you were smart during undergrad and you decided to do a major that doesn’t require you to seek a graduate degree in order to find a job. The most notable one as of 2020 is Computer Science. If you can code decently, you will easily find a job whether you decide to be a free-lancer or study hard to pass those stressful technical interviews.

According to Indeed, the average base salary of a Software Engineer in the US is about $108,741 with about a $4,000 cash bonus at the end of the year. An entry level software engineer straight out of school will make about $101,609 plus stock options, bonuses, 401k matching, etc. But let’s just be conservative and say it's $100,000. Of course, I know in some cities you’ll get paid less, other companies won’t give you a 401k match or stock options, but let’s just take this hypothetical number to make the calculations easy.

For the 2019-2020 Tax Filing year, if you lived in a booming urban city like New York, you’ll be giving away $31,796 to the IRS. That means about 32% of your money never reaches your pocket! (Now remember, this is a very simplified calculation that can be adjusted with 401k contributions, which we’ll talk about a little more later.)

Shocking right? That starting 6-figure salary just took a huge haircut!

Now let’s think of this in terms of time. Assuming you work 40 hours per week for 48 weeks (4 weeks go to paid vacation time), your hourly rate is $52.08.

But remember, the government just took about $32,000. If we use our hourly rate of $52.08, you just worked 610 hours for free to make that $32,000 to give to Uncle Sam that year. Now think of this in terms of weeks. This is about 15 weeks or 3.8 months. Let’s just go ahead and round 3.8 up to 4 months. You just gave up 25% of your year to the government!

Now let’s assume that this percentage stays true regardless of raises, promotions, etc. because taxes can go up - the more money you make, the higher tax bracket you fall into, and cost of living rises each year. That means that over that 22 to 65 year time frame, you’ll have given away 10.75 years of your life, working for free. That sucks - that’s 10 years of my life I could’ve been traveling, learning something new, or spending time with my family!

Okay, let’s say you’re a bit more financially savvy and you heard from friends and family to max out your contributions to your 401k and a Roth IRA. As of 2019, the maximum contribution to a 401k is $19,000 and for a Roth, you can contribute $6000 in a single calendar year.

(The Roth situation works for us here because we’re just under the Modified Gross Adjusted Income limit of $122,000).

If you’re contributing to a normal 401k, you can deduct that $19,000 from your taxable income, meaning you’ll be giving away $24,142 in taxes.

Now say you split up your $6000 after-tax contribution to your Roth over 12 months. This means you’ll be taking away $500 from your monthly spending.

Well assuming very conservative monthly costs, this is how much you’ll have leftover each month to spend on food, clothes, presents, traveling, things you like, etc.

Source: Numbeo

Sure, when you turn 65, you’ll have a pretty decent nest egg assuming the market returns a 6% return (we’ll talk about these retirement numbers in a different post). But what about today?

By this logic, you’ll have less than $500 a week to spend now for everything that you actually care about! This is going to really hurt during Christmas time when we’ve got all those extra costs for presents to buy.

And how many years did you give up in the process? Well over that 43 year period of having next to nothing saved to do anything you wanted to do, that’s still 8.7 years of your time you gave away for free. If we assume that the average person will live until 80 years old, that’s more than 10% of your life.

Ten. Freaking. Percent. That you never got to live because you were trading your time for money only to give it back to Uncle Sam.

And this is BEFORE we’ve considered any lost opportunity costs from your taxes!

Now let’s break this down monthly without Retirement Contributions:

Now these are all very conservative average prices with their sources linked in the table of fixed costs that everyone has to pay. This is also assuming that you do not own a car and are renting an apartment.

This leaves you only $3,316.34 a month to spend on food, traveling, gifts, things you enjoy… Not too shabby right? Well I would agree if only life wasn’t constantly evolving.

Every year rent will increase, renter’s insurance rates may skyrocket, your cell phone plan may get upgraded. I mean think about it from this perspective, if you opted to upgrade your phone to a base model iPhone 11 Pro, that’s $999 - almost half of what you have left over monthly!

Sure, you can put it on a payment plan, but what about if you want to spend $100 on groceries and $100 on restaurants every week. Those of you who have ever visited New York know that this is incredibly easy to do. Well now you’ve just taken away $800 from your $3,316.34. That’s almost 25% of what you had leftover!

And this is BEFORE we’ve considered any lost opportunity costs from your taxes! So, the moral of the story is, even if you make a 6-Figure Salary, the government will take a huge chunk of it. But really, they’re not just taking your money, they’re taking away your time.

Don’t get me wrong, taxes are not all bad - they pay for a lot of the amenities that we have in life. But if you take a moment to understand how they work, you’ll be able to minimize how much of your time is given away. In future posts, we’ll explore how to change the way we look at life to “buy back” time - something we thought was impossible.

*Nguyening Lifestyles is not a registered financial service provider and does not give financial advice. All information in these posts are for entertainment purposes only. Nguyening Lifestyles is not liable for any actions or outcomes that transpired after your reading of the following post.